The inadequacies of the UK housing market are well-known. Rising demand, particularly in major cities, is not being kept up with by supply. Adjacent housing markets also get a lift, as priced out workers look for cheaper commuting options – as shown by close parallel movements between major cities and their neighbours.

While price increases are indicative of a growing economy, the magnitude of such increases has for some time outpaced regional economic growth. This has led to a hunt for a culprit – with both landowners and developers standing accused.

The Blame Game Part i) – Developers

Many have pointed the finger squarely at developers[1]. They argue that housing developers could reduce their prices and, consequently, profit margins, so more affordable homes could be built. But herein lies a problem – developers can get away with demanding high profits. The concentrated market for development (partly a product of the financial crisis), gives major players the market power to set steep profit thresholds meaning some parts of the country don’t even get a look (see Table 1, which shows the healthy profit margins of major developers, giving support to this theory. The publicity surrounding payouts to Persimmon boss Jeff Fairburn has also not helped the developers’ case).

The other contested theory is that developers indulge in land hoarding and land speculation. Table 1 shows the land banks at the disposal of some of the big players. From one perspective, this shows a shocking amount of withheld land which could easily meet the government’s identified housing target of 300,000 extra houses a year. But many would argue that owning the assets to carry out a five-year business plan is simply being prudential. Speculative behaviour is harder to prove – but would require evidence of resale for profit at significant levels to be made positively.

The Blame Game Part ii) – The Landowners

Perhaps then, the landowners are to be held responsible. They, after all, must decide whether to sell land in the first instance.

It can be argued that any kind of land ownership is a form of monopoly power, as each plot of land is unique, in a different location, with different surroundings. In some circumstances, such as where land is owned on the outskirts of major cities, landowners can sit back, knowing that the demand pressure for their site will only grow, particularly if the site is large enough to develop a significant number of homes. And when the city is such a large hub that it draws from areas all around (such as London) property in commutable towns and cities (such as in Guildford and Reading) will also only go one way in value[3].

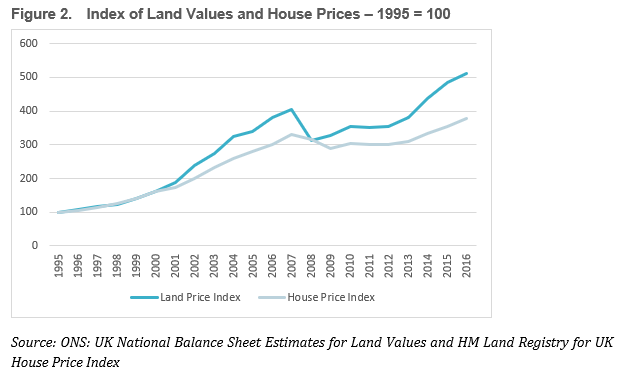

Developers might also note that land values have been growing at a faster rate than house prices since the financial crisis (see figure 2). If rising developer profits were the sole factor behind house price increases, then these would be increasing at the same rate – but they’re not.

Finally, developers could argue that their own failings begin with land prices – high land values leave developers highly leveraged, leading developers to withhold supply (known as a slow build out rate) to avoid increasing market supply and reducing their remuneration. The current UK build out rate is equivalent to 15.5 years[4], meaning it takes 15.5 years on average to build a large site (over 1,500 dwellings), with 6.5% of sites being completed every year. Arguably, lower land values would reduce the need for this behaviour.

The Letwin Review: a way to move on?

While it may be cathartic to bash developers and landowners, it will bring little comfort to those feeling crippled by mortgage payments, or commuting absurd distances in order to live in a more affordable area. We need the market to create better incentives to “do the right thing” on both sides. Into the void steps Oliver Letwin with his recent review[5], identifying measures to combat slow build-out rates in response to the UK housing crisis. Key recommendations include:

Giving local authorities more power in places of high housing needs to designate particular sites as “large sites” which must meet new diversity requirements.

Making government funding for housebuilders conditional upon the builder and the landowner accepting a Section 106 agreement which conforms with new planning policies aimed at increasing the diversity of offerings on large sites.

Unveiling new taxing powers that correlate to land values to prevent hoarding and to capture land value.

Letwin’s Big Idea – use diversity to lower house prices

Letwin’s key contribution is that more diverse housing portfolios lead to a reduction in land prices. A Section 106 agreement to increase the diversity of homes on large sites (1,500 or more homes) could lessen land prices by reducing the total development value of a site. These different housing types would also naturally attract a wider range of developers (reducing the land holding of each) and, by reducing the degree of substitution between houses on the site will allow the local market to absorb more houses without pushing prices down, meaning quicker build out. Such a policy would regulate both developers and landowners, by lowering developer revenue and profit, and deflating land prices. (It has the added benefit of creating more interesting and varied housing developments – unlike the sometimes soulless identikit estates which are commonly found off British major roads).

Regrettably, the MHCLG’s response to the Letwin Review is not entirely enthusiastic[6]. While they accept the report’s findings, and nod their heads to the recommendations put forward, there is no explicit commitment to implement Letwin’s policy proposals, but rather a preference to modify existing regulations. The identification of suitable (large) sites will remain centralised with Homes England, and won’t be devolved to local authorities, while further diversification requirements will not be made enforceable by a new section 106.

A way forward

The Government’s commitment to affordable housing is not in doubt. By guaranteeing £3bn of borrowing to housing associations, at a reduced interest rate, the Spring Statement demonstrated the Government’s commitment to tackling the housing crisis. This is a starting point to overcome the undersupply of housing by housing the financially strained and facilitating the development of general market housing on the same sites.

Nevertheless, tackling a problem which is ultimately a market failure requires more than extra cash, but reform to the fundamentals of the system. Letwin’s diversity proposal is one of the more creative approaches to come forward in recent times, which would reduce the market power of both developers and landowners on large sites. The government should be prepared to think big, and take action.

Sources

[1] Unsurprisingly, land owners support this hypothesis – see: The Strategic Land Group: Land values, house prices and why land value capture won’t make homes cheaper

[2] Shelter: Land Banking: What’s the Story? (part 1)

[3] Savills: Market in Minutes: UK Residential Development Land

[4] Letwin Review: Independent Review of Build Out

[5]https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/752124/Letwin_review_web_version.pdf

[6]https://www.parliament.uk/business/publications/written-questions-answers-statements/written-statement/Commons/2019-03-13/HCWS1408/